BTC Price USD Explained: The Ultimate Power Guide to Bitcoin Value in 2025

What Does BTC Price USD Mean?

The term btc price usd refers to the current market value of one Bitcoin expressed in United States Dollars. In simple words, it tells investors how much USD is required to purchase a single Bitcoin at any given moment. This price changes constantly due to market activity, making it one of the most closely watched indicators in the cryptocurrency world.

Understanding Bitcoin as a Digital Asset

Bitcoin is a decentralized digital currency that operates without a central authority like a bank or government. Instead, it relies on blockchain technology and a distributed network of computers to validate transactions. Because Bitcoin has a fixed supply of 21 million coins, its value is heavily influenced by scarcity and demand.

Why USD Is the Global Benchmark

The US dollar is considered the world’s primary reserve currency. Most global commodities, stocks, and cryptocurrencies are priced in USD. As a result, the btc price usd is the most widely referenced Bitcoin valuation across exchanges, news platforms, and financial institutions.

How BTC Price USD Is Calculated

Role of Crypto Exchanges

Cryptocurrency exchanges such as Binance, Coinbase, and Kraken determine Bitcoin’s price through real-time trading activity. When buyers and sellers place orders, the most recent transaction sets the current price. These prices are then averaged across platforms to show a global market value.

Supply and Demand Mechanics

When demand for Bitcoin increases and supply remains limited, prices rise. When demand falls, prices drop. This basic economic principle is the core driver behind Bitcoin’s price movements.

Bitcoin Halving Events

Every four years, Bitcoin undergoes a “halving,” reducing the reward miners receive for validating transactions. This event cuts new supply in half and has historically led to major price increases over time.

Historical Trends of BTC Price USD

Early Bitcoin Years

In 2010, Bitcoin was worth less than one dollar. Early adopters used it mainly for experimental transactions. Over time, awareness and adoption increased, pushing prices higher.

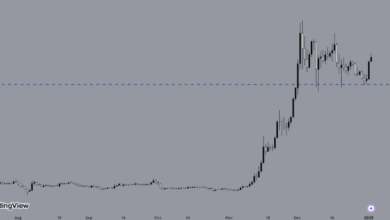

Bull and Bear Market Cycles

Bitcoin has experienced several boom-and-bust cycles. Prices surged dramatically in 2017, 2021, and again in later years, followed by corrections. These cycles are normal in emerging markets and reflect investor behavior and market maturity.

Key Factors Influencing BTC Price USD

Market Sentiment and News

Positive news such as institutional adoption or ETF approvals often drives prices up. Negative news, like exchange hacks or regulatory crackdowns, can cause sudden drops.

Government Regulations

Regulatory clarity tends to boost confidence, while uncertainty creates fear. Countries that support crypto innovation usually contribute positively to market sentiment.

Inflation and Interest Rates

When inflation rises, investors often look to Bitcoin as a hedge. Conversely, higher interest rates can reduce risk-taking, impacting crypto prices.

BTC Price USD vs Other Fiat Currencies

Comparison With EUR and GBP

While Bitcoin is also priced in euros and pounds, USD pairs usually have the highest trading volume. This makes the USD price more stable and widely accepted for analysis.

Tools to Track BTC Price USD in Real Time

Crypto Market Websites

Platforms like CoinMarketCap and CoinGecko provide live price updates, charts, and historical data. These tools help investors stay informed at all times.

🔗 External resource: https://coinmarketcap.com

Mobile Trading Apps

Most crypto apps offer price alerts, allowing users to monitor Bitcoin movements even while on the go.

Investment Strategies Based on BTC Price USD

Short-Term Trading

Day traders use price charts and technical indicators to profit from small price movements. This strategy requires experience and strong risk management.

Long-Term Holding (HODLing)

Long-term investors buy Bitcoin and hold it for years, believing its value will increase as adoption grows. This strategy reduces stress from daily price fluctuations.

Risks Associated With BTC Price USD

Volatility Risks

Bitcoin is known for sharp price swings. While volatility creates opportunity, it also increases risk, especially for inexperienced investors.

Security and Exchange Risks

Storing Bitcoin on insecure platforms can lead to losses. Using hardware wallets and reputable exchanges helps reduce these risks.

Future Outlook of BTC Price USD

Expert Predictions

Many analysts believe Bitcoin will continue to grow as digital assets become mainstream. Increased institutional adoption, limited supply, and global demand suggest a positive long-term outlook, though short-term volatility will remain.

Frequently Asked Questions (FAQs)

1. What determines btc price usd?

It is determined by supply and demand across global cryptocurrency exchanges.

2. Why does btc price usd change so frequently?

Bitcoin trades 24/7 worldwide, and constant buying and selling cause price fluctuations.

3. Is btc price usd the same on all exchanges?

Prices are similar but may vary slightly due to liquidity and trading volume.

4. Can beginners invest based on btc price usd?

Yes, but beginners should research, start small, and use trusted platforms.

5. Is btc price usd affected by inflation?

Yes, many investors see Bitcoin as a hedge against inflation.

6. Will btc price usd increase in the future?

No one can guarantee it, but long-term trends suggest potential growth.

Conclusion

Understanding btc price usd is essential for anyone interested in Bitcoin investing. It reflects market demand, global economic conditions, and investor confidence. While Bitcoin remains volatile, its growing adoption and limited supply make it a powerful digital asset worth monitoring closely. By staying informed and using reliable tools, investors can navigate the market more confidently and make smarter financial decisions.