XRP Price USD Analysis: What History Can Teach Us About Its Future

The world of cryptocurrencies has witnessed massive growth and volatility in recent years. Among the many digital assets, XRP stands out due to its unique utility and its backing by Ripple Labs. As the market continues to evolve, understanding the trajectory of XRP price USD is essential for investors, traders, and enthusiasts. By examining historical trends and market behaviors, we can make educated projections about where XRP might be headed in the future.

What Is XRP and Why Does It Matter?

XRP is a digital currency created by Ripple Labs, designed to enable fast, low-cost international payments. Unlike many cryptocurrencies that rely on decentralized systems, XRP is backed by Ripple, a centralized company with partnerships across the financial sector. This unique position has made XRP a popular choice for institutions, offering real-world use cases in cross-border payments and remittances.

One of the key aspects of XRP is its consensus mechanism. While Bitcoin and Ethereum use proof-of-work and proof-of-stake, respectively, XRP uses a consensus algorithm called the RippleNet. This allows XRP transactions to be processed in seconds, offering a solution to the delays and high fees typical of traditional financial systems.

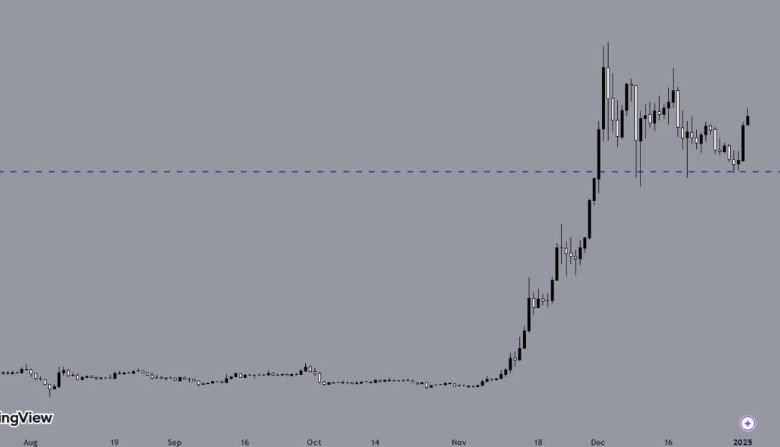

Historical Performance of XRP Price USD

To understand XRP’s potential future, it’s important to look at its historical price movements. XRP was initially launched in 2012 at a price of just $0.005. Over the years, it has experienced several periods of rapid growth, driven by both market sentiment and technological developments.

One of the most significant price surges occurred in late 2017, when XRP reached an all-time high of $3.84. This meteoric rise was fueled by the excitement surrounding the broader cryptocurrency market and increased institutional interest in Ripple’s technology. However, the surge was followed by a significant correction, with the XRP price USD dropping back to around $0.50 by early 2018.

The price of XRP remained relatively stable for the next couple of years, oscillating between $0.20 and $0.60. However, the volatility returned in 2020, following a lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against Ripple Labs. The lawsuit alleged that Ripple’s sale of XRP constituted an unregistered securities offering. This legal battle has led to significant price fluctuations in XRP, as investors grapple with the uncertainty surrounding its future regulatory status.

XRP Price USD: The Impact of Legal Challenges

The ongoing legal battle with the SEC has been a key factor in XRP’s price performance. When the lawsuit was first announced in December 2020, XRP’s price saw a sharp decline, losing more than 50% of its value in just a few days. The uncertainty surrounding the case has led many investors to be cautious, and XRP Price USD has been closely linked to the progress of the lawsuit.

Despite the challenges, Ripple has continued to make strides in the financial sector. The company has secured numerous partnerships with major financial institutions, including Santander and PNC Bank, which have helped bolster the use of XRP in cross-border payments. This practical use case could play a critical role in sustaining demand for XRP, even in the face of regulatory uncertainty.

As the lawsuit progresses, the market is eagerly awaiting the outcome. If Ripple wins the case, it could pave the way for a new era of regulatory clarity for XRP and other cryptocurrencies, potentially driving XRP Price USD to new heights. Conversely, if Ripple loses, the consequences could be dire, leading to a massive sell-off and a significant drop in XRP’s price.

What Can History Teach Us About XRP’s Future?

History has shown that XRP, like most cryptocurrencies, is highly volatile. However, it also offers lessons that can help us understand potential future price movements. Here are a few key takeaways:

- Market Cycles: XRP has experienced several boom-and-bust cycles, much like other cryptocurrencies. The volatility in XRP Price USD has been tied to broader market trends, regulatory news, and technological advancements. For instance, XRP’s price surged during the 2017 crypto bull run but quickly corrected once the market cooled down. This pattern suggests that XRP, like many cryptocurrencies, tends to follow broader market cycles.

- Institutional Interest: One of the key drivers of XRP’s value has been institutional adoption. Ripple’s partnerships with major financial institutions are a testament to XRP’s real-world utility. This trend is likely to continue, as more banks and payment providers look for faster, more cost-effective solutions for cross-border payments. XRP’s price could benefit from further institutional integration, as financial institutions increase their reliance on the token for remittances and payments.

- Regulation and Legal Factors: The ongoing legal battle between Ripple and the SEC has had a significant impact on XRP Price USD. The outcome of the lawsuit will likely set a precedent for how other cryptocurrencies are regulated in the United States. If Ripple is able to reach a favorable settlement or win the case, it could provide a positive signal to the market, driving XRP’s price higher. However, if the SEC wins, it could result in stricter regulations and a decline in XRP’s value.

- Technological Developments: Ripple continues to innovate within the blockchain and payment sectors. If the company is able to expand its network and improve its technology, it could create additional demand for XRP. Moreover, Ripple’s focus on sustainability, with initiatives to reduce carbon emissions in its operations, may appeal to environmentally-conscious investors, providing a new avenue for growth in the future.

Conclusion: What’s Next for XRP Price USD?

The future of XRP Price USD will be influenced by a combination of market trends, legal outcomes, and technological advancements. While the regulatory landscape remains uncertain, the increasing adoption of Ripple’s technology and its partnerships with financial institutions provide a solid foundation for future growth.

If Ripple can navigate its legal challenges successfully, XRP could see significant price appreciation, potentially reaching new all-time highs. However, investors must remain cautious, as regulatory hurdles and market volatility could lead to sharp price corrections. By looking at XRP’s historical performance and considering the various factors at play, we can gain valuable insights into what might lie ahead for this unique cryptocurrency.